The Tax tables below include the tax rates, thresholds and allowances included in the California Tax Calculator 2025. The California marginal tax rates are higher than most of the states, but not the highest. To figure out how much a taxpayer owns in taxes, he or she needs to calculate taxable income first, then use the tax brackets for to see the tax liability. In this guide, we’ll break down the 2025 California tax brackets, explain who needs to file, highlight standard deductions and tax credits, and provide key deadlines to help you avoid penalties. Plus, we’ll show you how to track your tax refund and answer some common tax questions.

- For 2025, while the tax rates remain unchanged, income brackets have shifted, impacting how much you owe.

- Technically, you don’t have just one „tax bracket” – you pay all of the California marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar.

- The federal standard deduction for a Head of Household Filer in 2024 is $ 21,900.00.

- The 2021 tax rates and thresholds for both the California State Tax Tables and Federal Tax Tables are comprehensively integrated into the California Tax Calculator for 2021.

- The Earned Income Tax Credit (EITC) is a significant tax credit in the United States, designed primarily to benefit working individuals and families with low to moderate income.

Forms

The credit amount varies based on the taxpayer’s income, marital status, Online Accounting and number of qualifying children, with the intention of providing greater assistance to families with children. Income tax deductions are expenses that can be deducted from your gross pre-tax income. For details on specific deductions available in California, see the list of California income tax deductions. Technically, you don’t have just one „tax bracket” – you pay all of the California marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar. For comparison purposes, however, your California tax bracket is the tax bracket in which your last earned dollar in any given tax period falls. Of course, income tax rates will vary depending on each taxpayer’s individual finances.

About FTB

- The Tax tables below include the tax rates, thresholds and allowances included in the California Tax Calculator 2024.

- Many cities and counties also enact their own sales taxes, ranging from 1.25% to 4.75%, so the maximum combined rate is 10.75%.

- The credit amount varies based on the taxpayer’s income, marital status, and number of qualifying children, with the intention of providing greater assistance to families with children.

- If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you need further guidance, consider consulting a tax professional or using IRS Direct File for a hassle-free filing process.

The federal standard deduction for a Head of Household Filer in 2024 is $ 21,900.00. The federal standard deduction for a Head of Household Filer in 2021 is $ 18,800.00. The federal standard deduction for a Head of Household Filer in 2022 is $ 19,400.00. The federal standard deduction for a Head of Household Filer in 2025 is $ 22,500.00. If your state tax witholdings are greater then the amount of income tax you owe the state of California, you will receive an income tax refund check from the government to make up the difference.

California State Income Tax

This means that regardless of where you are in the state, you will pay an additional 6.00% of the purchase price of any taxable good. Many cities and counties also enact their own sales taxes, ranging from 1.25% to 4.75%, so the maximum combined rate is 10.75%. The table below shows state and county tax rates for each of the 58 counties in California. Its base sales tax rate of 6.00% is higher than that of any other state, and its top marginal income tax rate of 12.3% is the highest state income tax rate in the country. The Golden State fares slightly better where real estate is concerned, though. The average homeowner pays just 0.71% of their actual home value in real estate taxes each year.

- If you are looking to refinance or purchase a property in California using a mortgage, check out our guide to mortgage rates and getting a mortgage in the Golden State.

- The tax rates and brackets below apply to income earned in 2024, reported on taxes filed in 2025.

- California follows a progressive tax system, meaning the more you earn, the higher your tax rate.

- For a complete listing of the FTB’s official Spanish pages, visit La página principal en español (Spanish home page).

- Additionally, the funds in these retirement accounts grow tax-deferred, meaning that taxes on investment gains are not paid until the money is withdrawn during retirement, ideally at a lower tax rate.

- That said, it’s best to think about the tax rates as cups you need to fill in first to pay the designated portion rather than something as a whole.

- If your state tax witholdings are greater then the amount of income tax you owe the state of California, you will receive an income tax refund check from the government to make up the difference.

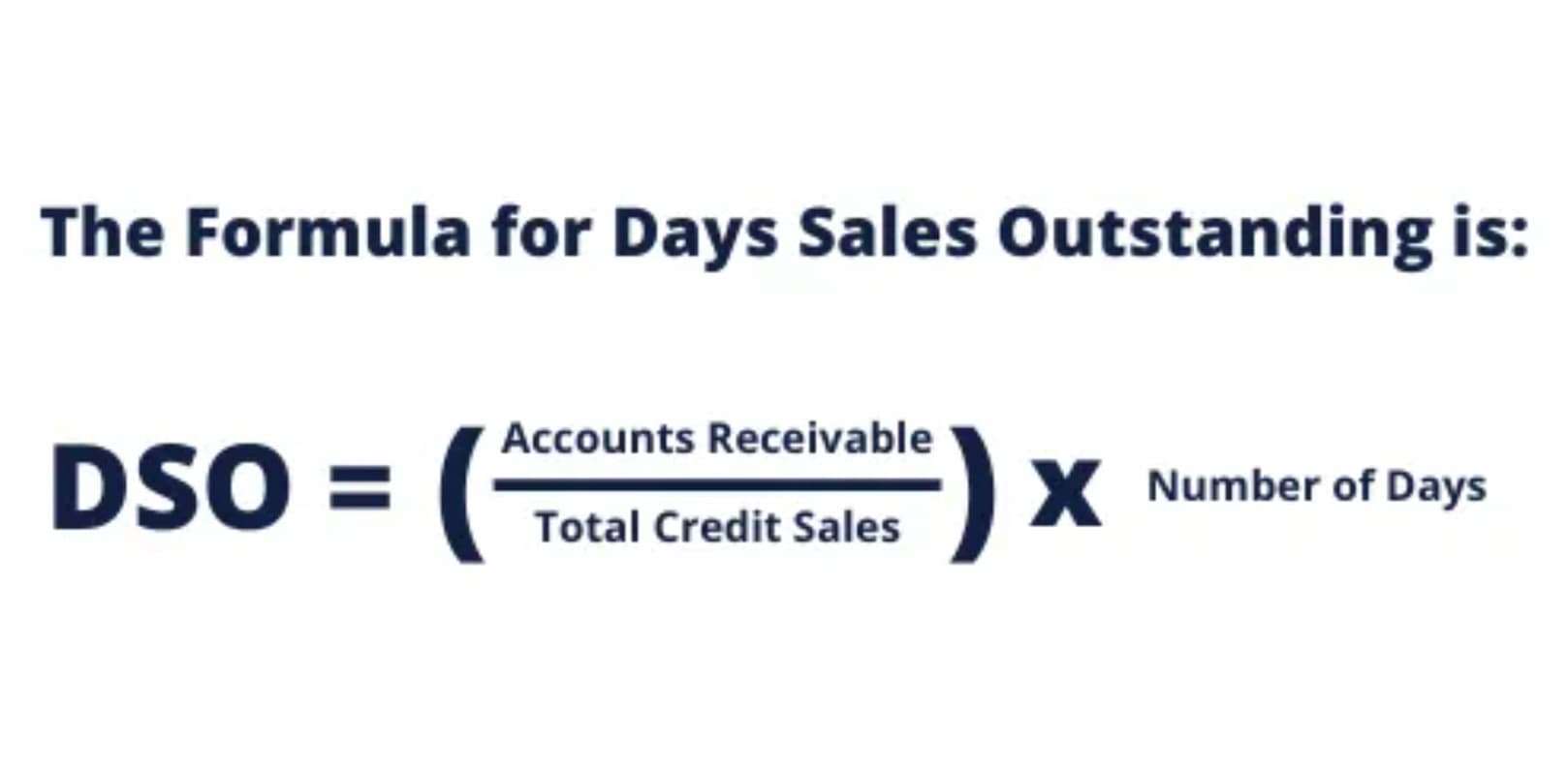

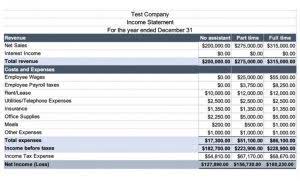

For a complete listing of the FTB’s official Spanish pages, visit La página principal en español (Spanish home page). Law Firm Accounts Receivable Management This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Advisory services are only offered to clients or prospective clients where Sweeney & Michel, LLC and its representatives are properly licensed or exempt from licensure.

The Income tax rates and personal allowances in California are updated annually with new tax tables published for Resident and Non-resident taxpayers. The Tax tables below include the tax rates, thresholds and allowances included in the California Tax Calculator 2019. The Tax tables below include california tax tables the tax rates, thresholds and allowances included in the California Tax Calculator 2023.